Dynamics 365 Business Central Canadian Payroll

Does Microsoft Dynamics 365 Business Central Have Canadian Payroll?

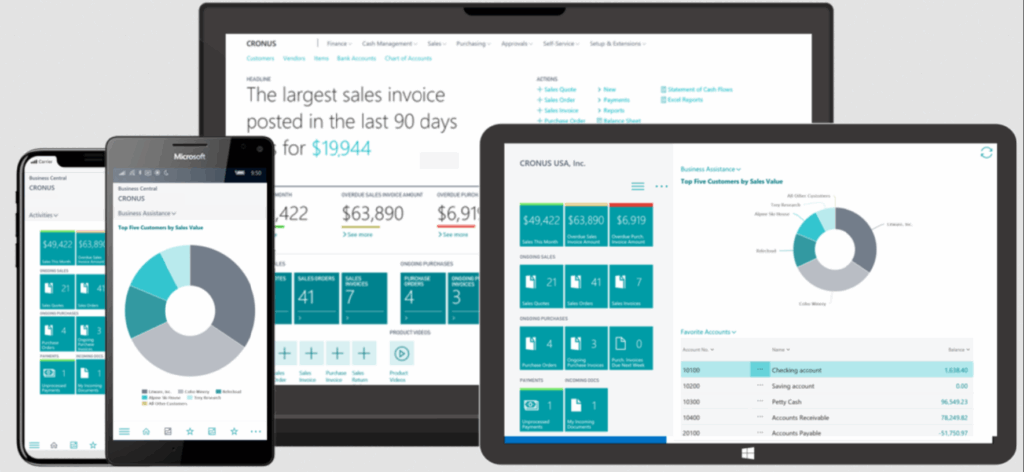

If you’re a Canadian business evaluating Microsoft Dynamics 365 Business Central as your ERP solution, one critical question arises: Can it handle Canadian payroll? The direct answer is no, Business Central does not include built-in Canadian payroll functionality. But don’t let that stop your implementation—leading third-party payroll solutions integrate seamlessly to deliver full compliance and automation.

This gap doesn’t mean Business Central falls short for Canadian operations. Instead, Microsoft designed it to connect flawlessly with specialized payroll providers. This ensures you get best-in-class payroll processing while leveraging Business Central’s strengths in finance, inventory, sales, and operations.

Why No Native Canadian Payroll?

Canadian payroll is notoriously complex. With:

Federal + 13 provincial/territorial tax regulations

CPP/QPP, EI, and varied deduction rules

Annual T4/T4A and RL-1 (Quebec) reporting

Frequent legislative changes

Building and maintaining compliant payroll within an ERP would be resource-intensive. Microsoft’s solution? Deep integrations with established Canadian payroll providers. This ensures accuracy, reduces your compliance risk, and lets you choose a payroll partner matching your business size and needs.

Top Canadian Payroll Integrations for Business Central

Connect these certified solutions for end-to-end payroll processing:

-

ADP Workforce Now

Canada’s largest payroll provider. Handles multi-province payroll, ROEs, direct deposit, T4s, and tax remittances. Real-time sync with Business Central GL. -

Ceridian Dayforce

Cloud HCM + payroll platform. Automates complex Canadian tax calculations, year-end reporting, and benefits. Strong for mid-market to enterprise. -

Payworks

Canadian-built solution ideal for SMBs. Manages payroll, time & attendance, and HR. Direct integration ensures accurate journal entries. -

Rise (by Paychex)

Affordable cloud payroll for small businesses. Covers all provinces, automates deductions, and syncs pay data to Business Central. -

QuickBooks Online Payroll

For smaller businesses needing simplicity. Integrates via connector apps for basic payroll sync.

| Payroll Provider | Ideal For | Key Features | Integration Type |

|---|---|---|---|

| ADP Workforce Now | Large Enterprises | Multi-province payroll, ROEs, T4s | Direct Sync |

| Ceridian Dayforce | Mid to Large Businesses | HCM + payroll, benefits, compliance | Native API |

| Payworks | Small to Mid Businesses | Payroll, HR, Time & Attendance | Direct Integration |

| Rise (Paychex) | Small Businesses | Affordable, automated deductions | Connector |

| QuickBooks Payroll | Small Startups | Simple payroll sync | Extension |

Key Features Your Integrated Payroll MUST Have

When choosing a solution, ensure it supports:

Automated Federal/Provincial Tax Calculations: CPP, EI, QPP, and provincial tax deductions.

Year-End Compliance: Auto-generates T4, T4A, and RL-1 slips.

Direct Deposit & Digital Pay Stubs: Essential for modern workforces.

ROE (Record of Employment) Management: Critical for employee transitions.

Real-Time GL Sync: Eliminate manual journal entries into Business Central.

Multi-Province Support: Vital if you operate across Canada.

Benefits of Integrating Payroll with Business Central

-

Eliminate Dual Data Entry: Payroll costs post automatically to your GL.

-

Reduce Compliance Risk: Providers handle tax updates and filings.

-

Gain Real-Time Insights: See labor costs against revenue in financial reports.

-

Streamline Processes: HR and finance teams work from a single data source.

-

Improve Accuracy: No manual transfers = fewer errors.

The Verdict: Business Central + Canadian Payroll Integrations = Success

While Business Central doesn’t offer native Canadian payroll, its ecosystem of certified integrations provides a stronger, more compliant solution. By connecting specialized payroll providers like ADP or Ceridian, you gain:

Guaranteed compliance with CRA and provincial agencies.

Automation of complex deductions and remittances.

Seamless financial visibility within your ERP.

This approach ensures Canadian businesses get both world-class ERP functionality and payroll precision without compromise.

Next Steps for Canadian Businesses

Assess Your Needs: Consider employee count, province coverage, and HR complexity.

Demo Integrated Solutions: Test top providers like ADP or Payworks.

Partner with a Specialist: Work with a Microsoft Partner experienced in Canadian Business Central implementations (they’ll handle integration setup).

Need Help Navigating Options?

For Canadian businesses, this integration means accurate payroll processing, tax compliance, and streamlined financial management—all within the powerful Business Central ecosystem.

Need help choosing the right payroll system? Contact us for Canadian implementations!

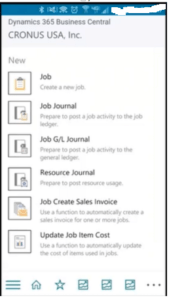

As well to simply import payroll transaction to Microsoft Dynamics 365 Business go Microsoft Link To use this functionality, an extension for payroll import must be installed and enabled. The Ceridian Payroll and the Quickbooks Payroll File Import extensions are pre-installed in Business Central.

Frequently Asked Questions

No, Microsoft Dynamics 365 Business Central doesn’t include native Canadian payroll, but it integrates seamlessly with providers like ADP, Ceridian, Payworks, and Rise to ensure full compliance and automation.

Because Canada’s payroll system involves complex federal and provincial tax regulations, making integration with specialized third-party providers more efficient and reliable.

Top integrations include ADP Workforce Now, Ceridian Dayforce, Payworks, Rise by Paychex, and QuickBooks Payroll via connectors.

You can use pre-installed extensions like Ceridian Payroll or QuickBooks Payroll File Import to upload and sync payroll transactions within Business Central.

Yes, certified Canadian payroll providers ensure CRA and provincial compliance with automatic tax updates and year-end reporting (T4, T4A, RL-1).

About the Author

Marketing Admin is part of the KDP Solutions digital team, specializing in Microsoft Dynamics 365 solutions, ERP optimization, and business automation. With deep expertise in cloud ERP for Canadian SMBs, their goal is to help companies achieve operational efficiency through integrated technologies.

About the Organization

KDP Solutions (Kaizen Dynamics Partners Inc.) is a trusted Microsoft Partner based in Canada, offering ERP, CRM, and cloud transformation services. With 10+ years of experience serving clients across North America, KDP specializes in Microsoft Dynamics 365 implementations, customizations, and business automation for sustainable growth.